All Insights Case Study Re-Haul The Loan Conversion Process

Our client, a leading mortgage servicer and sub-servicer, was facing process and data-related challenges in their loan boarding process:

- Timeliness: The process for boarding new-loans information was manual, and took upto 15 days for each transfer

- Accuracy: Accuracy of loan information could not be measured and errors were a part of almost all transfers

- Non-compliance: CFPB-mandated notifications were frequently sent after the 15-day deadline was past

- Incomplete information: For loans where the data is received from a prior servicer, mission-critical (loss mitigation, in-flight modifications) information was never captured, or was captured inconsistently and inaccurately

Axtria re-hauled the client’s entire loan boarding process, starting with a detailed review of the business definition, usage and appropriateness of the boarding information. In particular, information related to in-flight loss mitigation cases was mapped onto client systems for the first time.

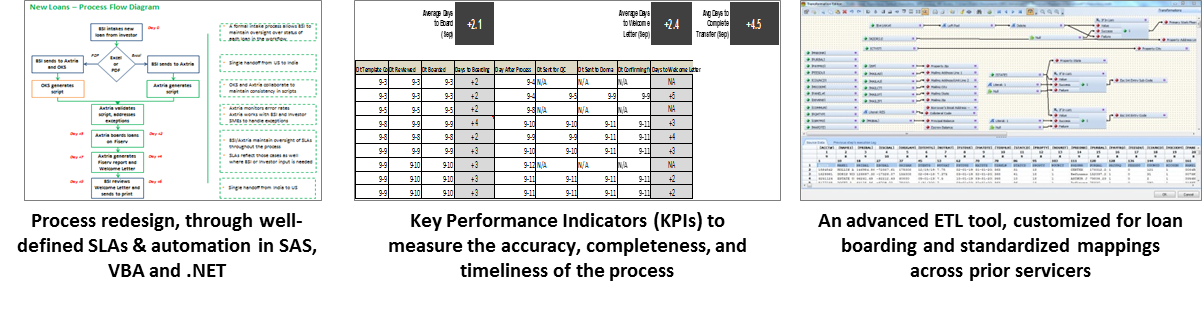

In addition, Axtria designed and implemented the following key process enhancements:

The results were phenomenal:

- Boarding information, especially loss mitigation data, mapped to above 90% across prior servicers

- The SLA for new loans boarding reduced from more than 15 days to less than 6 days for sending government-mandated borrower notifications (time reduced by 60%)

- The time for capturing seasoned loans information reduced to less than five hours, and the boarding time reduced to less than 3 days of receiving (time reduced by more than 80%)

- Completeness and accuracy increased to more than 90% for 30 ‘Key Business Elements'