Top Data Challenges During Pharma Mergers And Acquisitions

Regardless of the industry, mergers and acquisitions (M&A) are highly competitive and give rise to multiple changes for the companies involved. One of the most challenging aspects for pharma companies is merging the large data sets from the two organizations. That involves integrating systems, applications, operational processes, and technologies before the acquired organization’s data assets are under control and fully accessible to the integrated entities. Data management in the M&A process will have a profound effect on the success of the newly enlarged enterprise, and while integrating two massive data sets into one comprehensive platform can be daunting, there are steps organizations can take to overcome these challenges. This article will cover the top data challenges faced during pharma M&As and suggest some best practices to overcome them.

The challenges

Knowing what kind of data the acquired company collected: In this age of data revolution, pharma companies generate and collect substantial data volumes from multiple primary and secondary data sources.1 Some sources include clinical trials, patient services, sales operations’ customer relationship management (CRM) software, adverse events, social media, and the Sunshine Act2 database. Understanding one’s own data is complex, and understanding a new partner’s data can be even more challenging. There are many hurdles when integrating data from another organization, including:

-

Weeding out some information on the acquired company’s competitors’ products, markets, sales trends, customers, and financial performance. One example is redundant-obsolete-trivial (ROT) data, often called “dark data,” which complicates data mergers and lengthens the integration process due to its enormous volume and complex structure.

-

Complying with all foreign and domestic laws associated with data collection and sharing, such as the Health Insurance Portability and Accountability Act (HIPAA) or the European Union’s General Data Protection Regulation (GDPR), related to personal information or the American Medical Association’s Physician Data Restriction Program (PDRP), which lets doctors limit sales rep access to their prescribing history.3

-

The increased amount of time and resources needed for the acquiring firm to combine internal and external information across multiple departments.

Data silos: With multiple data sources come the various structures that store them. Often, no centralized data storage or commercial data lake exists, so understanding this data during mergers becomes very difficult when tacit knowledge is lost to staffing changes during transitions. Even when both businesses have created perfect data lakes, utterly free of silos, there can still be challenges to overcome. Essentially, the two companies’ data are two giant data silos. Data silos of any size create many problems, but silos of this magnitude can cause significant problems. They increase costs, slow decision-making, limit access to valuable information, and make it more difficult to find answers when needed.

Data risks during the M&A process: During an M&A, each entity’s data is more exposed than before. Most employees4 typically filter out potentially risky emails and are cautious about what they open. However, amid acquisitions and mergers, staff members loosen up. They are more prone to become victims of phishing, malicious emails, and hackers since they are encouraged to anticipate communications from another company. Additionally, there is a chance that data may be lost when we integrate employees from the rival business into our ecosystem. As files are moved around, and access privileges are changed, it is easy for data to be missed or accidentally deleted.

Data integration: To fully realize the potential of each part of the newly merged company, we must connect the data sets of the two enterprises. The larger organization’s vast data repositories will surely be helpful to the smaller company throughout the merger. Likewise, the smaller company’s data may offer insights that help the merged corporation develop more quickly. Hence, data integration is necessary for such benefits to be realized. But when a company grows, it is more likely to use some custom technological solutions like a CRM system. Similarly, as a company becomes older, the probability that it has some legacy systems rises. These weaknesses, which might be very difficult to overcome and potentially cause the entire merger to fail, will be accentuated when comparing the participating organizations' systems.

Enhancing analytics: The evaluation process can begin once the data has been successfully integrated. Various analytics use historical data to calculate incentives, fiscal budgeting, and risk modeling. One company may have data from a comparatively shorter time frame, which could skew the results of the analytical model.

The solutions

The unique data challenges pharma companies face during mergers and acquisitions require a customized approach. Some of the best practices for overcoming these obstacles are:

-

Partnering with a strategic consultant: These issues could require the assistance of an independent technical expert and a business analytics expert, but an excellent place to start is to map out each company’s technical infrastructure and identify employee training gaps. To ensure a smooth transition, training in the new system should ideally begin before the transaction has been completed.

-

Acquiring software: The danger of data loss inevitably rises as we include more personnel in the data ecosystem. Accidental data deletions are a prevalent cause of data loss, so having the proper tools to keep things organized is crucial. In these times of change, relying entirely on the employees to manage data merging would almost certainly lead to human mistakes, which could result in data breaches.Purchasing the appropriate software is the first step in preparing companies for integration. The next step after data integration is to choose the best data storage facility, control access, and organize shared information between the two firms. The combined organization will then have simple access to all its data, and the company will operate as usual.

-

Automation: During an M&A, the only way to sift through the newly acquired data is with the help of an intelligent data automation application that can unlock the silos and reveal the data in a useful form. Several exist, including offerings by IBM and ADP. Built with artificial intelligence/machine learning (AI/ML) capabilities, applications like these can help clarify how datasets can be categorized and combined since each firm may have petabytes of data or more, which can be very time-consuming if done manually.

-

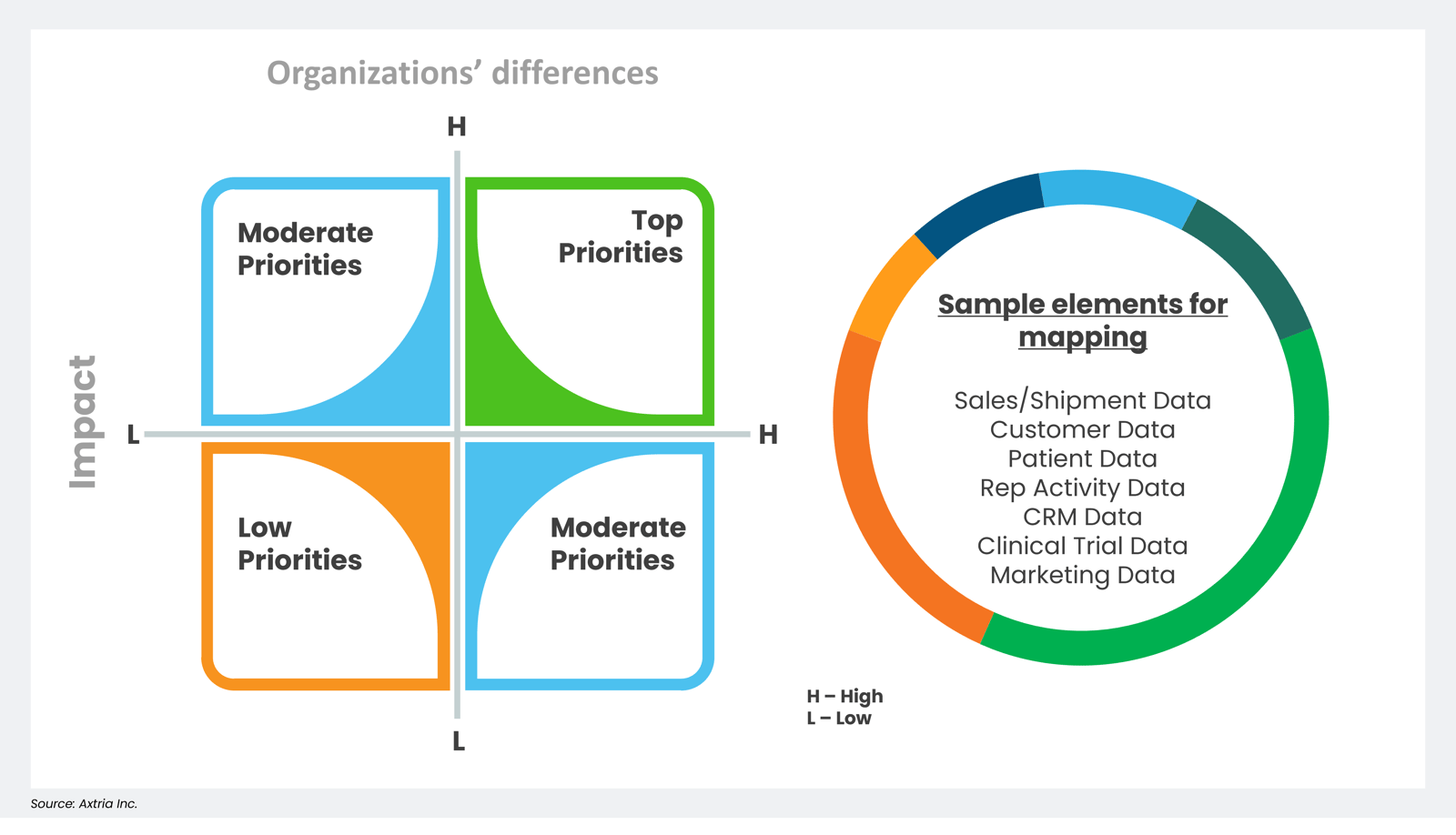

Map priorities and determine an integration strategy: Leaders from the legacy organizations must analyze both data sets thoroughly to map differences and find areas that need specific attention. Creating the most efficient integration plan relies on the new management team knowing how significant the differences are and how the merger will affect the way things are done in the new company. Identifying and prioritizing the integration areas that will most influence the organizations’ differences allows the management team to choose the ideal time to implement certain integration efforts. Creating a thorough integration management strategy and communication plan with periodic reviews during the integration ensures the merger will fulfill the company’s goals. A simple four-square matrix, as shown below, can be helpful in this process.

Figure 1: Prioritizing value in M&As

Conclusion

A well-planned integration process that considers the difficulties of merging data during an M&A is crucial to a successful outcome. Only by addressing these issues from the beginning can businesses create the conditions for rapid top-line development, decide what data must be preserved or erased, and obtain fresh insights to improve their operations. In the end, effective data management can help businesses avoid post-merger integration failure and complete an M&A successfully.

References

- Vazquez J. 6 important pharma data collection sources to keep an eye on. P360. October 2, 2019. Accessed October 3, 2023. https://www.p360.com/birdzai/6-important-pharma-data-collection-sources-to-keep-an-eye-on/

- American Medical Association. Physician financial transparency reports (Sunshine Act). January 28, 2020. Accessed October 3, 2023. https://www.ama-assn.org/practice-management/medicare-medicaid/physician-financial-transparency-reports-sunshine-act

- American Medical Association. AMA physician data restriction program. Updated July 3, 2023. Accessed October 3, 2023. https://www.ama-assn.org/about/physician-professional-data/ama-physician-data-restriction-program

- Patel K. The impact of mergers and acquisitions on companies & employees. July 24, 2023. Accessed October 3, 2023. https://dealroom.net/blog/impact-of-mergers-and-acquisitions-on-employees

Author details

Abhishek Singh

Abhishek Singh is a passionate leader with over a decade of experience in global sales operations, analytics, and consulting. His skill set includes sales force optimization, goal setting, incentive compensation, and territory management, all honed in complex data-driven environments. Abhishek excels in crafting impactful sales compensation plans and innovative contests. His extensive experience extends across primary care, specialty medicine, oncology, and rare diseases markets, making him a versatile asset in the healthcare industry.