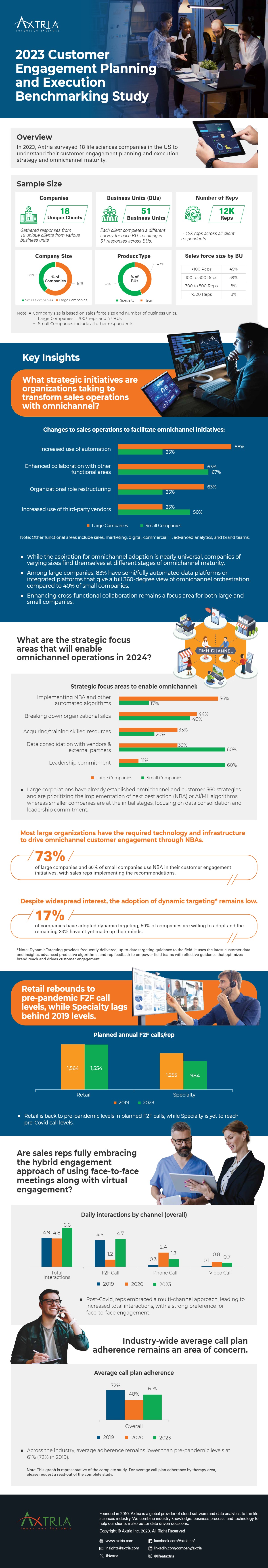

2023 Customer Engagement Planning and Execution Benchmarking Study

The digital transformation of society and technological advancements in data analytics and artificial intelligence (AI) have notably accelerated the transformation of customer engagement. The need to comprehend the consequences across various facets of field force planning and execution, ranging from segmentation and targeting to activity planning, plan generation, and field execution, stems from the altering preferences of the Healthcare professionals (HCPs), the influence of digital trends, and the readiness for omnichannel orchestration.

In an omnichannel world, the role of the field force is an augmented one, with a shift in expectations from simple demand generation to encompass more intricate and coordinated engagements. Most companies are already responding to the evolving environment by directing their commercial investments in building a sophisticated omnichannel orchestration ecosystem to drive superior customer engagement and improve brand reach.

In Axtria’s 2023 Customer Engagement Planning and Execution Benchmarking Study conducted across life sciences organizations in the US, we cover key areas such as:

- Organizational approaches to customer engagement planning and execution

- Benchmarks for the critical areas of sales force strategy – segmentation and targeting, activity planning, activity plan generation, and field execution

- Insights into omnichannel maturity, dynamic targeting approaches, next best action, and organizational adoption

2023 Customer Engagement Planning and Execution Benchmarking Study

Recommended insights

Report

Article