Health systems have undergone a seemingly interminable transformation through an ever-increasing progression of mergers and acquisitions (M&A) activities that have escalated over the past decade. With its emphasis on accountable care and clinical integration, the Affordable Care Act helped accelerate the formation of integrated delivery networks (IDN). An IDN is an organization or health system that owns and operates a network of healthcare facilities. They often contain many different types of inpatient and outpatient care facilities, including hospitals, physician groups, health clinics, ambulatory surgery centers, and imaging centers. Due to the shift from volume to value in healthcare delivery, hospitals had to adapt as Accountable Care Organizations (ACOs) began to form.1 While the pace of M&As initially slowed during the early part of the pandemic, the rate of consolidation within the industry not only returned to its previous tempo but accelerated, due in part to the injection of billions of dollars from COVID-19 aid directly to the health systems. Despite the current global health crisis, the driving forces behind the consolidation of these systems remain the same:

- Achieving greater economies of scale

- Reducing costs

- Enhancing capabilities and expanding capacity

- Making use of synergies

- Acquiring knowledge and talent

- Expanding competitive advantage

- Gaining financial flexibility by acquiring cash, building debt capacity, and spreading risk

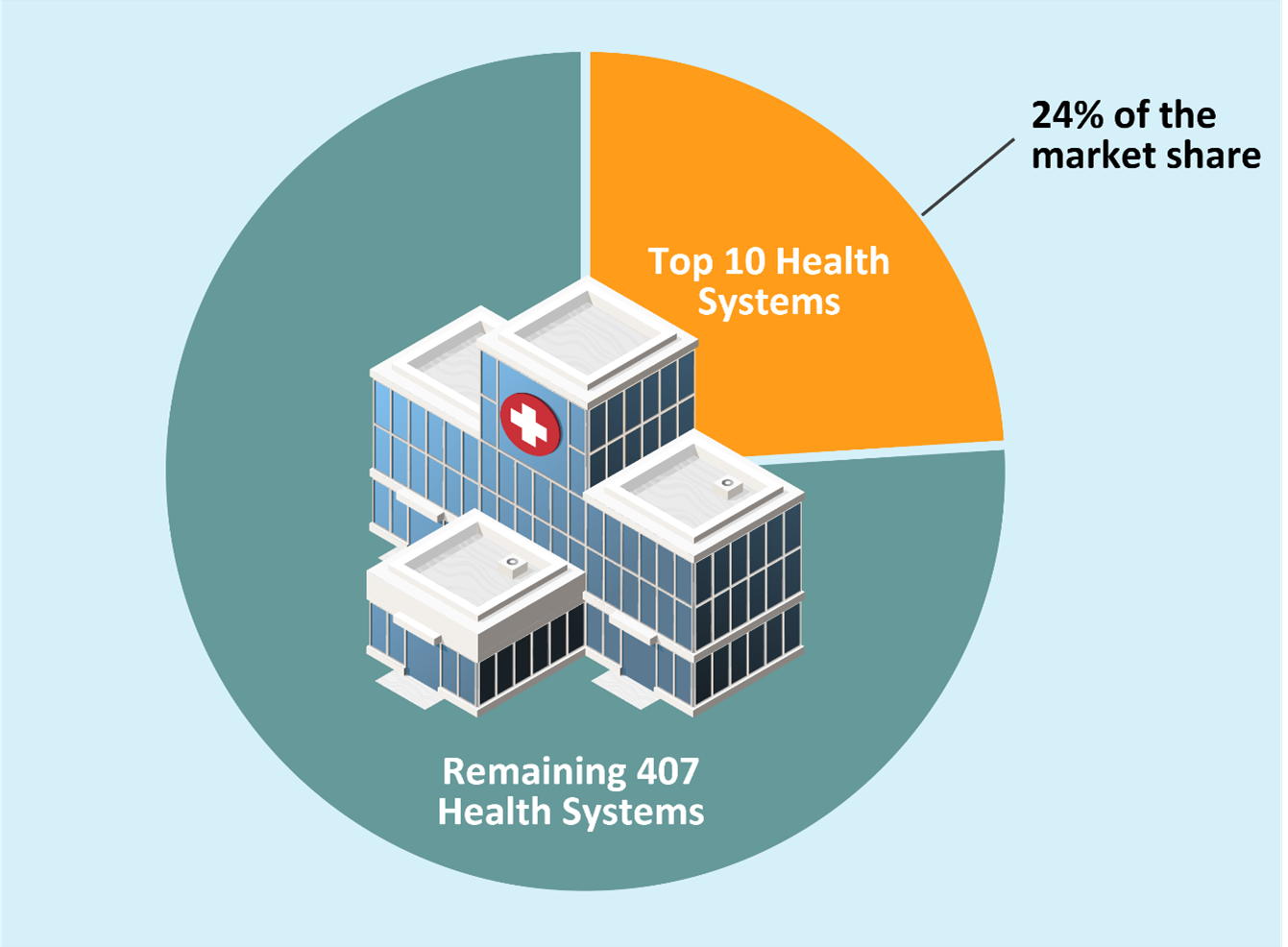

.As a result of this consolidation, there are numerous impacts on the hospital landscape. Overall, the average number of hospitals per health system has increased while the total number of health systems has decreased. According to the American Hospital Association (AHA), at the beginning of 2021, there were 6,090 US hospitals—67% of them were system-affiliated.2 As more hospitals are acquired or merged with other systems, this percentage will continue to increase. This growth in affiliated hospitals is most prominent among the largest health systems, where the top 10 systems account for 24% of the market share (Figure 1).3

Figure 1: Health System Share of Market

Source: American Hospital Association2 and Deloitte Insights3

There has been extensive research and much public debate about the impact of health system consolidation on patient access, care, and outcomes. But the question remains: what are the implications for the MedTech companies that sell into these ever-expanding systems? As physician practices and specialty groups merge, the potential exists for reducing redundant facilities and operating rooms, thus reducing the need for capital equipment and associated consumable products. Additionally, as hospitals and systems fall under another system’s umbrella, the potential also exists for the newly merged organizations to leverage “best of the best” contract pricing, resulting in a sales margin reduction that would not have occurred if the systems had not merged. As health systems grow, so does their bargaining position, creating downward price pressure.

From a customer-facing perspective, how do health system M&As impact sales representatives and key account managers? Let’s first explore this from the corporate/organizational level and review the effect of the mergers on key account managers (KAMs). These associates are often the first point of contact for a customer. A KAM’s main point of call is not a medical facility, but typically a health system home office or business office. In this regard, the items below demonstrate how selling to IDNs is more complicated than selling to just one care facility:

- A KAM needs to design a pitch for the C-Suite, not the traditional department head or influential surgeon

- The MedTech company’s offering must meet firm criteria for return on investment (ROI)

- KAMs must understand the IDN’s influence in local markets if they are to be effective in negotiating a larger contract.

- The KAM must understand the big picture, along with pain points. Specifically, who are the physicians, who are the patients, and what are the patients being treated for? What is the mission/vision of the IDN? Will the KAM’s bag of products help meet those objectives or merely be “nice to have?” What pressures are the IDN facing, and how can the MedTech company’s offerings alleviate those pain points?

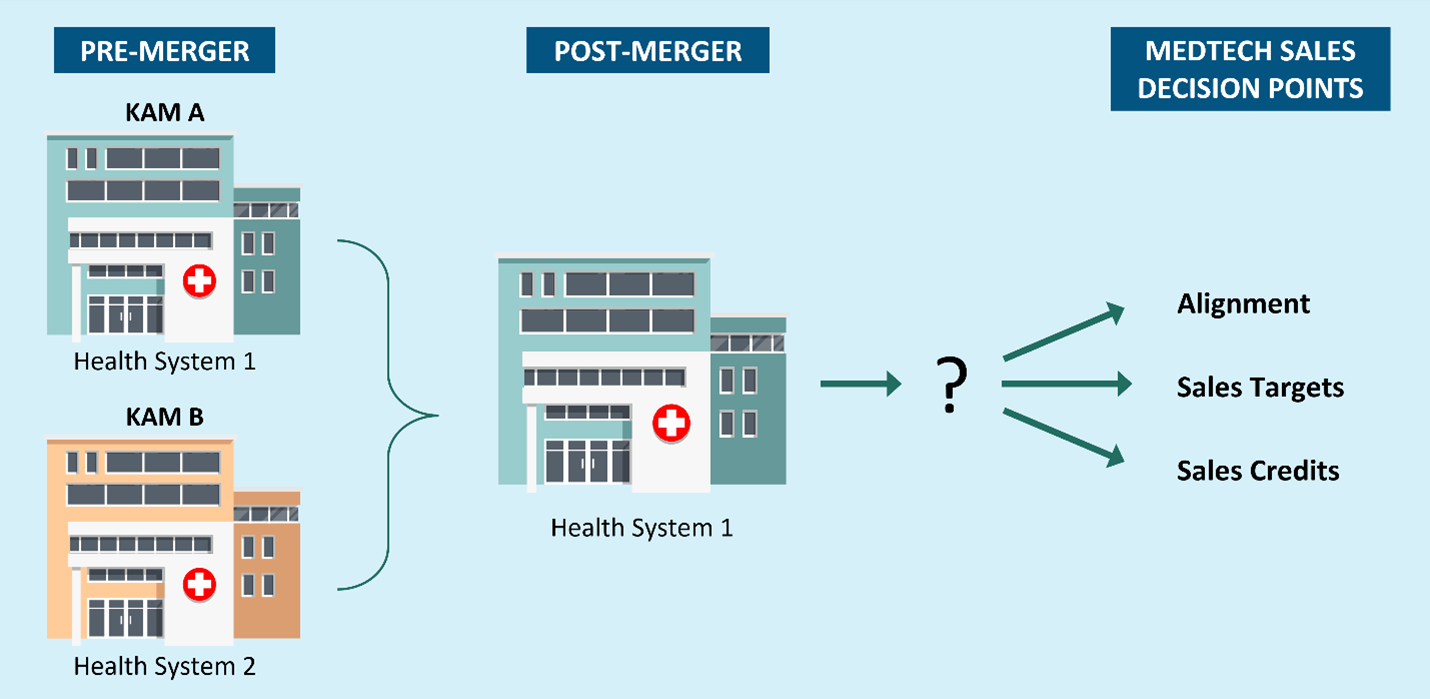

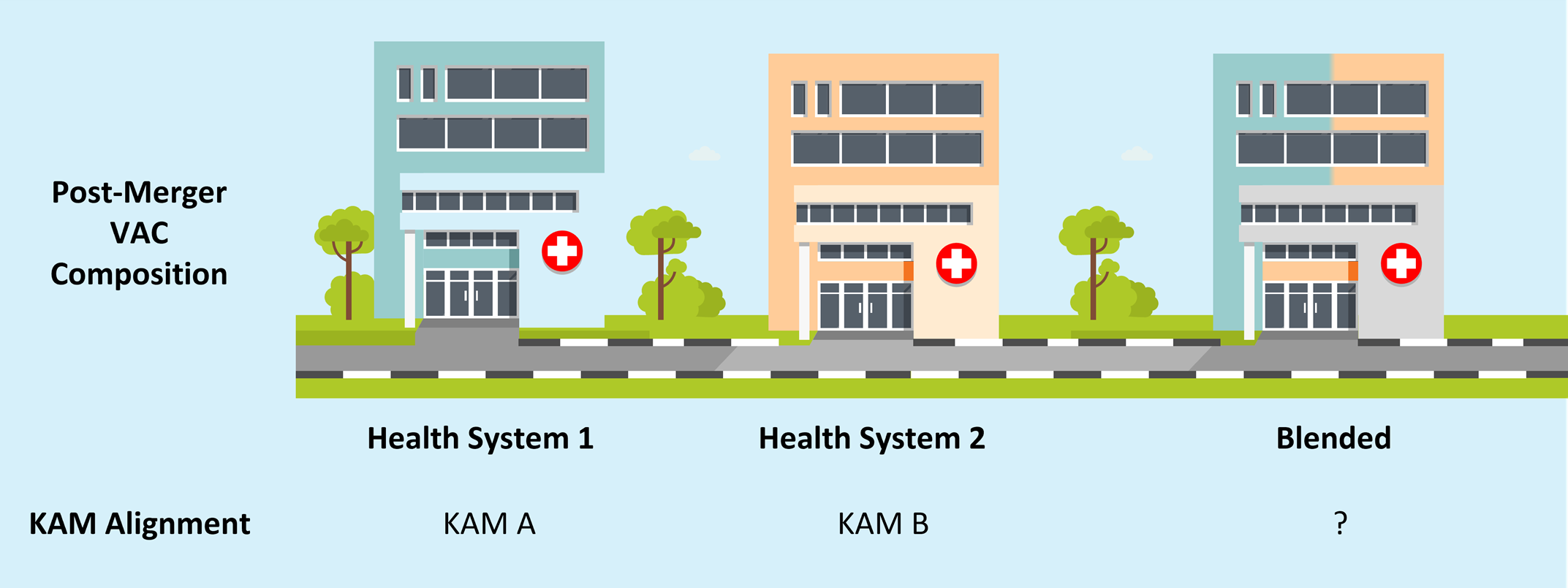

As the number of health systems diminishes, there is a corresponding reduction in a KAM’s points of call. Moreover, KAMs are frequently account-aligned rather than geographically aligned, making it interesting, as well as vexing, to revise alignments, quota impact, and sales credits among KAMs. Consider the following scenario: KAM A is aligned to Health System 1, KAM B is aligned to Health System 2, and the systems merge. Within one sales plan period, only Health System 1 remains (Figure 2).

Figure 2: M&A Impact on Alignment, Sales Goals, and Sales Crediting

Source: Axtria Inc.

From an alignment perspective, deciding which KAM should manage the relationship with the new system can be challenging. The importance of the KAMs’ existing rapport with the customer cannot be overstated. In instances where cost-cutting measures are deployed, and operational units are eliminated or merged/blended, consideration must be given to the composition of the Value Analysis Committee (VAC) when determining which KAM is better suited to continue their engagement with the health system (Figure 3). VACs determine product value, control the product formulary, and ensure clinicians comply with the formulary. The VAC is frequently the gatekeeper for adding a product to the IDN-approved product list or adding it to a contract. The VAC will evaluate numerous factors to determine the most appropriate vendor selection, including existing vendor contracts, overall cost/benefit, and alignment to IDN core values.

Figure 3: KAM Alignment Determination based on New System Composition

Source: Axtria Inc.

For data-driven companies tracking customer engagement, the voice of the customer, and other customer interaction measures, assigning a KAM to the account should be both straightforward and transparent. KAM alignment should be based on the values captured in the Customer Relationship Management software, thus eliminating the need for subjective, qualitative, and “gut feel” approaches to assessing the strength of each KAM’s relationship with the customer. Besides these customer-facing metrics, other quantitative means, such as system sales volume vs. KAM portfolio size, can be applied to determine the most equitable way of assigning the account.

How does a merger impact sales targets and sales credit for companies incentivizing their KAMs based on system-aligned performance? Quotas based on alignment can be complicated when healthcare providers move in and out of different networks. Likewise, if the quota was initially based on a specified number of sites within an IDN, newly-added sites would require a quota adjustment. This may not sit well with the KAMs, since they may feel their leadership is “moving the goalpost.” In this case, a quarterly quota would better suit the complexities and fluidity of IDN movements. For instances such as these, it is imperative to continuously monitor and analyze the impact of new IDN M&A activity and one-off site additions or removals. Additionally, timing may play a prominent role in handling this question. A sales performance management (SPM) platform with the flexibility to change the roster of health systems and the hospitals in those systems, along with the associated sales, can produce a very different result from one that requires data to remain frozen with the KAMs throughout the sales period. Each scenario has different and compelling angles to consider.

Learn More - " The Top Three Benefits of Managing Customer Affiliations "

While IDN roster changes may pose the biggest impact on KAMs, there are also implications for the “boots on the ground” sales reps who actively sell into the IDN member hospitals. With buying decisions shifting from clinicians and department heads to central purchasing, points of call will also shift. As a result, not only will sales reps need to talk about the clinical outcomes of their products as they would have with a physician, but they will also need to talk about ROI impact and other financial benefits. Specific to the financial angle, sales reps will likely feel the downward price pressure caused by this restructuring and face tighter margins and lower sales prices as IDNs leverage larger economies of scale.

One of the most challenging aspects a sales rep may face is the possibility of being “locked out” of formerly “friendly” hospitals. As hospitals and health systems change hands, the influence of vendor empanelment (e.g., the addition of a vendor to the approved list) and IDN contracts is key. The health system making an acquisition may have more favorable contracts in place with competitors than with the existing supplier. Some reps and KAMs may collaborate, as there may be an opportunity to demonstrate the value of the acquired hospital and attempt to flip the entire IDN. In reality, while it is possible the preexisting contract will be honored through its original term (typically 36 months), being able to make large sales or introduce new products is usually difficult. The more likely scenario is that the acquired hospital will begin to shift its purchasing to the preferred system vendor or “wait out the clock” on the existing contract.

The business functions that support sales and account management teams must consider a broad spectrum of possible problems:

Marketing – Different audiences need different value propositions based on their local market needs.

- Does your message speak of the value proposition and appeal to the right audience?

- Is the GTM strategy aligned with the needs of IDN and VAC?

- Does each account employ a different strategy and, in turn, a different value proposition, so it appeals to different cultures, missions, and corporate objectives?

- Does your marketing approach consider the need to customize messaging to each target/customer?

- Are you hiring sales reps and KAMs who can grasp the new market dynamics?

- As interactions with IDNs increase in importance, does your team have the requisite experience to work with customers effectively?

- Are you taking the necessary steps to ensure that you will be able to retain this level of talent?

Team Dynamic – As systems increase in size and KAMs shift IDNs:

- Do you have a plan that shares responsibilities among KAMs so they can meet the needs of a growing organization?

- Do you have a seamless, collaborative environment for KAMs and sales reps to work together to engage the customer and make the most of sales opportunities?

- Have you created clear guidance for how each role should support the other roles?

Training and Upskilling – The right training is critical to developing and maintaining a sales force that can readily navigate changing alliances.

- Are you providing training that enables the sales team to sell in this new value-based environment?

- Are your marketing messages and sales propositions aligned?

- Are you preparing your sales reps to play the role of the KAM by providing sufficient training?

Technology – With IDN consolidation, more time is spent researching the customer's needs, wants, and demands to create a value proposition. This effort goes beyond just the technical knowledge of a product. It also factors in financial and behavioral aspects. Sales reps and KAMs must be adept at using technology to pull in such information and analyze the data.

Infrastructure – As needed, the sales reps and KAMs should be supplemented with assistance from additional teams who can help prepare the value proposition.

- Is your company’s infrastructure sufficiently organized and aligned to provide these value-added insights?

Data – As IDNs change, it is critical to keep data current and accessible so teams can use it effectively.

- Does your organization have an easily accessible, intuitive, and democratized data landscape capable of supporting these data needs as they increase in scope and complexity?

- Does your company follow an established process for tracking changes in membership/ownership through M&A activities?

- How is your organization obtaining updated hospital rosters, and once known, is it making the necessary changes in sold-to, ship-to, bill-to, etc., on a timely basis?

- How has your organization structured the relationships in accounts to ensure they can track same-store sales, current system sales, and any combination of sales history to reflect each ownership scenario?

Omnichannel – With more stakeholders in different decision-making roles:

- Are you effectively using omnichannel to provide customers with the right information in the right mode at the right time?

- Do you have enough content corresponding to each consumption mode to effectively support demand generation?

Given the current rate of acquisitions and the frequency with which hospitals shift ownership, the impact on MedTech sales teams can be nuanced and complex. Companies selling in this environment need robust and dynamic mechanisms that adjust to M&A changes with speed and agility. Groups supporting sales functions must be equipped to deal with the ongoing variability in IDN membership. MedTech companies must be prepared to flex with changes in hospital ownership/rostering and have a data and SPM solution that is fine-tuned to this high degree of variability. Does your sales/commercial operations team have the appropriate tools and solutions in place to be able to handle these changes? Our deep knowledge and experience in MedTech, along with our industry-proven thought leadership, services, and solutions, allow Axtria to help prepare your organization for future commercial success amid an environment of constant change. With the landscape continuously evolving to meet the demands of a complex commercial model, Axtria empowers you to make intelligent decisions and reach the right customers at the right time with flexibility and agility.

Learn More - "The Growth Of Ambulatory Surgical Centers"

REFERENCES

- Clarivate. Integrated delivery networks and their growing influence on regional healthcare in the United States [Internet]. London: Clarivate Plc; 2019 Oct [Cited 2022 Sept 12]. Available from https://clarivate.com/blog/integrated-delivery-networks-and-their-growing-influence-on-regional-healthcare-in-the-united-states/

- American Hospital Association. Fast facts: U.S. health systems infographic [Internet]. Washington, DC: American Hospital Association; 2020 [cited 2022 Sept 12]. Available from. https://www.aha.org/infographics/2021-01-15-fast-facts-us-health-systems-infographic

- Prevost T, Skillrud I, Gerhardt W, Mukherjee D. The potential for rapid consolidation of health systems: How can hospitals use M&A to innovate for the future? [Internet]. New York: Deloitte Insights; 2020 Dec [cited 2022 Sept 12]. Available from https://www2.deloitte.com/us/en/insights/industry/health-care/hospital-mergers-acquisition-trends.html

.jpg?width=690&height=468&name=AI-ML-in-life-sciences%20(1).jpg)