In the first blog of this two-part series, we highlight two of the four key forces driving changes in the healthcare ecosystem, encouraging medical device companies to rethink their traditional commercial models.

If you could generate billions of dollars in shareholder value, over three years, by revamping your commercial models, would you do it?

Medical device companies have repeatedly contemplated on similar questions while facing the fundamental forces transforming their industry. Their desired outcomes:

- Market share gains

- Increased sales growth

- Reduced commercial model operating costs

Execution of the necessary steps towards these objectives has often included complete overall of a few operations, calibration of some, and wait-and-watch for the rest. This blog reviews what transformed the outlook of the medical devices industry.

| Traditionally, medical device companies focused on creating innovative products, new delivery systems, and of course, strengthening their relationships with healthcare physicians (HCPs). |

Traditionally, medical device companies focused on creating innovative products, new delivery systems, and of course, strengthening their relationships with healthcare physicians (HCPs). As companies felt pressures of growth and competition, the industry also observed forces in the healthcare ecosystem that challenged the traditional commercial approach. With the new digital world order, data availability made the need for ‘incremental changes’ shift toward ‘transformational changes.’ The trick was to use data and insights to manage operations as an outcome of innovation, pricing and cost of therapy, and healthcare outcomes leading to improved patient quality of life outcomes leading to improved patient quality of life. The impact of these operational changes, it was hypothesized, could change customer perceptions and the nature of relationships in the ecosystem, that would eventually impact go-to-market outcomes and revenue models.

Some of the critical healthcare ecosystem forces influencing the medical devices market:

DIGITAL TRANSFORMATION

The entire healthcare ecosystem, with the medical devices industry right at the center of healthcare diagnostics and delivery, is today driving towards patient-centricity. Meaning, medical device companies need to adopt, master, and leverage big data, advanced analytics, and digital solutions to transform their ability to understand the complex stakeholder behaviors and perceptions, and be able to react appropriately at the right moment.

Learn More - "Laboratory Information Systems and Medical Device Industry"

Digital adoption and transformation, for a complex manufacturing to services industry such as medical devices, can be at various levels:

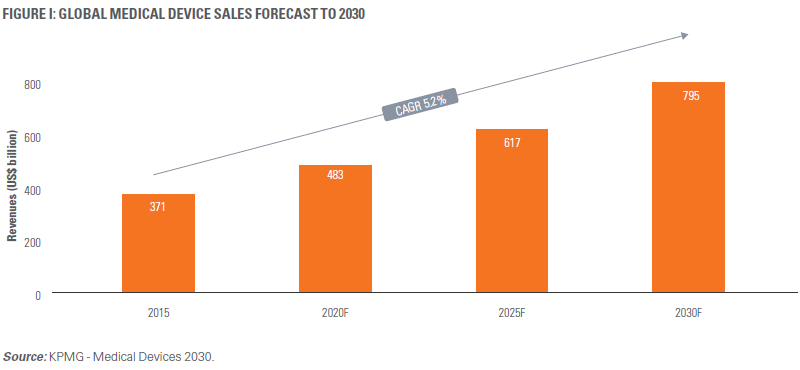

- MARKET ASSESSMENT: The medical devices market is estimated to grow to $800 billion1 by 2030 (Figure 1), with studied hearsay pointing to >15,000 product categories, from diagnosis (lab reagents and digital microscopes) to delivery (invasive and non-invasive to healthcare-at-home) to lifestyle (disease management and wearables). Companies need to adopt and consume big data ingestion technologies, cloud computing, and advanced analytics to get a grip of addressable market changes.

- PRODUCT DEVELOPMENT: With Robotics, Virtual Reality (VR) and Augmented Reality (AR) making constant forays into the HCPs’ ability to deliver cutting-edge healthcare benefits to patients2, product development has seen leaps and bounds of digital intervention with not just the ability to diagnose and repair, but also perform at scale, even remotely. Internet of Things (IoT) enabled wearables3 providing real-time feedback to the healthcare ecosystem, connected payer- provider-supply chain ecosystems, and cutting-edge minimally invasive surgical interventions are a result of constant digitally-driven medical devices product development.

- SUPPLY CHAIN: The medical devices industry is peculiar in the sense that the same product can be classified as both B2B and B2C, at the same time. Therefore, predicting market demand and manufacturing volume can be quite challenging. With patient at the center of healthcare delivery, making the products available to them is the single most absorbing investment in the demand estimation and production feedback mechanism. At the product delivery end, Geographic Information Systems (GISs) are at the helm of physical product delivery maps. Therefore, getting the product, either for diagnosis or recovery, makes the ability to absorb this data imperative. Furthermore, the ability to ingest this complex data from various sources across the value chain, create complex analytical models with multiple data points that ‘speak with each other,’ and deliver the insights to the business leaders is a critical need today.

- COMMERCIAL OPERATIONS: Product differentiation and awareness play a pivotal role in the medical devices industry. With regulatory implications preventing direct communication with the patients, companies rely on Key Account and Retail hybrid teams to reach out to the HCPs. Digital marketing teams walk on the ropes to convey the product differentiation and benefits across each product. The organization’s ability to maneuver through complex data to increase brand awareness and lead management is the key to driving growth. The good part is, it’s the digital world that yet makes this possible. For this, companies rely on multi-channel-marketing-planning, most driven digitally if not all. Even the feet-on-street is enabled with insights to make next-best-actions, based on the current situation.

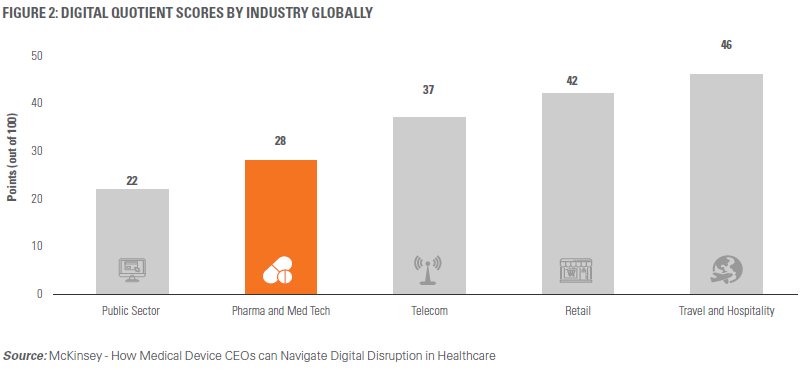

Medical devices companies are rapidly recognizing the power of digitization. With commercial digitization, on- demand data, and real-time insights, functions across the value chain such as product design and supply chain logistics can be optimized. That said, despite all the potential benefits, medical device companies are still ‘Digital Followers’4 to companies in other industries such as Retail and Hospitality (Figure 2).

EVIDENCE-BASED OUTCOMES

With the increasing pressure on pricing from across the healthcare and life sciences industry, HCPs are demanding real-world evidence (RWE) to prove improved patient outcomes and reduced overall cost of care. As value-based healthcare gains popularity, manufacturers need to continually look at incremental changes to healthcare outcomes by plowing the real-world-data into clinical benefits. With technology and advanced analytics having the ability to simulate results based on value inputs from pre-clinical, clinical and post- marketing surveillance information, the implementation of these outcomes is imperative to attract the regulators with innovations aimed at improving the quality and cost of care. For example, Innovative Trauma Care (ITC) invented a low-cost and easy to use clamp to manage bleeding from trauma wounds, proving immense value to the patients and physicians alike5.

The goal of patient-physician collaboration is to enhance clinical results and care value. To facilitate this change in outlook, medical device companies will need to leverage RWE-enabled patient-level analytics to better engage and collaborate with both stakeholders. The results can be quite forward-looking and rewarding (even as mentioned in the section of Digital Transformation). Minimally invasive surgeries2, implantable drug delivery systems6, wearables leading to HCP feedback on lifestyle and diet moderation7, and IoT deployed at hospitals and homes8 are some clear examples of evidence- based outcomes commercial direct patient benefits.

Learn More - "The Evolving Landscape Of MedTech For 2023 And Beyond"

Regulatory filings will need to keep up, and at the same time, keep-check on the fast-paced development. That said, the regulatory organizations are continually setting up new norms9 and keeping a vigil on adverse events and sub-optimal delivery10 of healthcare. Meaning the guardrails being developed due to constant generation of evidence of healthcare outcomes will continue being under check.

Learn More - "The Growth Of Ambulatory Surgical Centers"

REFERENCES

- Medical devices 2030, Making a power play to avoid the commodity trap, 2018 KPMG International Cooperative, January 5, 2018. Available at https://assets.kpmg/content/dam/kpmg/xx/pdf/2017/12/medical-devices-2030.pdf

- Minimally invasive surgery, Mayo Clinic, August 24, 2019. Available at https://www.mayoclinic.org/tests-procedures/minimally-invasive-surgery/about/pac-20384771

- Smart technology helps improve outcomes for patients with head and neck cancer, May 17, 2018, ASCO Perspective. Available at https://www.cancernetwork.com/head-neck-cancer/smart-technology-may-improve-head-and-neck-cancer-care

- ‘How medical-device CEOs can navigate digital disruption in healthcare,’ October 2017. Available at https://www.mckinsey.com/industries/pharmaceuticals-and-medical-products/our-insights/how-medical-device-ceos-can-navigate-digital-disruption-in-healthcare

- Chris Newmarker’s 3 steps to create value with your medical device, May 1, 2017. Available at https://www.medicaldesignandoutsourcing.com/3-steps-create-value-medical-device/3/

- Chapter 5 - Design of functionalized materials for use in micronanoscale drug delivery devices and smart patches. Ashleigh Anderson and James Davis, 2017, Pages 183-206. Available at https://www.sciencedirect.com/science/article/pii/B9780323461436000051

- Wearable Devices for Weight Loss, American Family Physician, December 1, 2018. Available at https://www.aafp.org/afp/2018/1201/p670.html

- Applications of the Internet of Things in the Medical Industry (Part 1): Digital Hospitals, June 24, 2018. Available at: https://dzone.com/articles/applications-of-the-internet-of-things-in-the-medi-1

- FDA Safety Communications. Available at https://www.fda.gov/medical-devices/medical-device-safety/safety-communications

- ‘The FDA Requests Allergan Voluntarily Recall Natrelle BIOCELL Textured Breast Implants and Tissue Expanders from the Market to Protect Patients: FDA Safety Communication.’ Available at https://www.fda.gov/medical-devices/safety-communications/fda-requests-allergan-voluntarily-recall-natrelle-biocell-textured-breast-implants-and-tissue