This blog is the second of a two-part series and highlights two of the four key forces driving changes in the healthcare ecosystem, encouraging medical device companies to rethink their traditional commercial models. Click here to read the first blog.

IMPACT ON PRICING DUE TO HEALTHCARE REFORMS

Government reforms to make healthcare more affordable for patients can potentially end up burdening the manufacturers. Funding reforms typically translates into taxation levied on products. On the other hand, counteracting these taxes is not simple for the manufacturers since there’s a constant push to reduce the price of products and increase overall healthcare affordability as well. So, the most apparent pressure a manufacturer would feel is of absorbing tax pressure from the customer price, which could potentially mean lesser profit margins across the value chain. For example, the US Patient Protection and Affordable Care Act (PPACA) levies 2.3% excise tax on the sales of most medical devices. The money collected through these measures is meant to be used for patient welfare and healthcare accessibility. The Centers for Medicare and Medicaid Services (CMS) provided funding for transitional care efforts with the Community-based Care Transitions Program (CCTP), channeling $500 million1 to qualified hospitals.

So, does this mean a positive or a negative impact on the medical devices industry? Innovation is the answer, across process, product, and go-to- market.

Learn More - "Laboratory Information Systems and Medical Device Industry"

Companies develop economies of scale over the years, so it may seem only natural to manage (or reduce) pricing. Counteracting the economies of scale is the need to increase reach and market access (which often also means offering products at differential pricing). This, of course, implies investment (or capital infusion) in product development and commercial operations across the value chain of product to the point-of-sales. Therefore, reevaluating product and commercial models to ensure product differentiation, cost efficiency, and maintaining operations at scale is the ever-changing need.

| Advanced analytics models use various forms of analogous real-world-data to pre-empt market forces and predictively calibrate the commercial operating models to keep the organization current, or even ahead of the curve. |

New-age commercial operations models, which use disruptive and incremental measures to manage change, and maintain the market status-quo during the shift, can be imperative. These advanced analytics models use various forms of analogous real-world-data to pre-empt market forces and predictively calibrate the commercial operating models to keep the organization current, or even ahead of the curve.

Learn More - "2023-2024 Challenges And Opportunities For Orthopedic Device Companies"

EVOLVING COMMERCIAL MODELS

The need to change commercial models is driven out of some of the reasons mentioned in the blog, but also intuitively due to rapid changes across each of these functions:

- OPERATIONS: Operational efficiency requirements driven by a fresh look at automation, re-usable components, need to do more with same, given cost pressures and need to stay ahead of the competition.

- PURCHASING: The shift toward centralized purchasing of medical devices, making it challenging to influence individual buyers and intervention of central bodies like GPOs (Group Purchasing Organizations) and IDNs (Integrated Delivery Networks).

- CUSTOMER ACCESS: The need to innovate communication channels with restrictions being implemented to reach ‘customers’ directly.

- COMPLICATED CUSTOMER STRUCTURES: The trend towards outsourcing specific care areas (e.g., clinics, ERs, ambulatory services, etc.) amongst many other areas.

- STRATEGY: Changes in strategy arising from new and previously unavailable data.

- HEALTHCARE OUTCOMES: The need to enable patient to derive benefits of each step of value and regulatory evolution.

- MARKET CONSOLIDATION: A wave of mergers and acquisitions2 from both the manufacturer and customer side to embrace speed and access.

- REGULATORY: External forces guiding every aspect of product and organization performance.

The result is visible – companies have started to transform their operations and go-to-market strategies with the necessary skills and capabilities to communicate the economic and clinical value of new products. The future models, therefore, are driven out of the data to insights to operations model. Not necessarily insourcing each aspect of this model, since the objective of the medical devices companies needs to be clear on their core strengths of product development for better healthcare outcomes and betterment of patient’s quality of life.

CONCLUSION

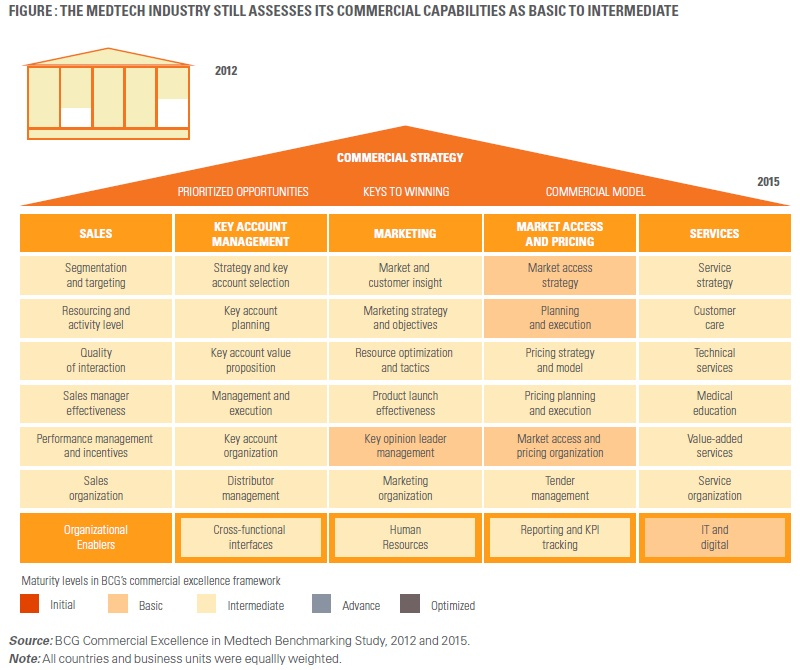

There is no escaping the fact that the medical device industry is undergoing a massive paradigm shift, making it interesting for all stakeholders and imperative for them to evolve. Despite this, industry experts admit that there is a significant runway for the medical device industry to progress in transforming commercial models3 and improving skills and talent (Please refer the below figure). At the same time, companies are resisting clear overhaul at their own expense.

The billions of dollars will follow. However, the billions of dollars will follow only if the companies can put the imminent industry transformation in the middle of their strategy and operations.

It is critical to identify the golden nuggets of emerging opportunities. An in-depth assessment of the changing market conditions and an appropriate upgrade of the commercial models can prove to be a first-mover advantage for those willing to take it. The ability to understand and absorb the change, deal with it through evidence (data), develop smart and agile commercial models, analytics platforms that are flexible enough to embrace the oncoming transformation and forward-looking nimble strategies have demonstrated impact and success stories with some prominent first-movers of the medical device industry.

REFERENCES

- Colleen K. McIlvennan, Zubin J. Eapen and Larry A. Allen’s Hospital Readmissions Reduction Program, May 19, 2015. Available at https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4439931/

- Priyanka Dayal McCluskey’s State, federal regulators sign off on Beth Israel-Lahey merger, Boston Globe, published online November 29, 2018. Available at https://www.bostonglobe.com/business/2018/11/29/state-federal-regulators-sign-off-beth-israel-lahey-merger/8orX00xkMSRORq0rXlj4sM/story.html

- Götz Gerecke, Andrea Miotto and Mills Schenck’s Moving Beyond the “Milkman” Model in Medtech, February 28, 2017. Available at https://www.bcg.com/en-in/publications/2017/medical-devices-technology-marketing-sales-moving-beyond-milkm