“U.S. Economy Sees Record Downturn”

The headline on the record drop in U.S. GDP for Q2 2020 at an annual rate of 32.9% and 9.5% from the previous quarter, The Wall Street Journal, print published July 31, 2020 [1].

Key Pharma Business Issues Being Affected by Economic Dynamics

The pharma industry is going through what could be considered its most challenging of times, as a perfect storm of issues face individual companies in need of new thinking and practical, actionable solutions. The public policy responses to the coronavirus pandemic with respect to business closure mandates, shelter-in-place, and social distancing restrictions have created an unprecedented macroeconomic environment, as indicated by the opening quote. U.S. jobless claims topped 1 million again for the 20th straight week ending August 1, 2020 as of the writing of this blog [2]. Weekly jobless claims since this report have continued to hover around the 1 million mark. The August 1, 2020 jobless claims number, and weekly numbers since, are significantly lower than what they were at the height of the restrictions and their accompanying effects. July 2020 ended with a national unemployment rate at 10.2%, down from the peak of 14.7%, but far higher than the 3.5% in February 2020 before the pandemic-induced shutdown policies took effect, and still higher than any time during the Great Recession of 2007-2009.

What the latest weekly jobless claims number also shows is an economy not experiencing a V-shaped recovery as earlier predicted by economists. Instead, more evidence is supporting a view of an economy recovering from the recession like an “accordion” or sustained W-shape [3]. Moreover, the consistently high level of jobless claims comes at a time when the $600 weekly enhancement in unemployment benefits provided by the federal government has expired, and a resurgence in COVID-19 that could cause a reimposition of restrictions. There seems to be no resolution with Congress and the Trump administration as to “when,” “if,” and “by how much” such enhancements in weekly benefits will be restored. Thus, pharma companies need to have economic-based models on how such dynamics affect patient affordability and access to insurance, thereby impacting future drug utilization and patient health outcomes [4].

![]() Learn More - COVID-19 Recession Effects On Pharmaceutical-Related Patient Health Outcomes

Learn More - COVID-19 Recession Effects On Pharmaceutical-Related Patient Health Outcomes

Also, there are significant sub-national variations in the state of the economy when looking at local metropolitan statistical areas (MSAs). This sub-national variation of effects across MSAs is placing greater emphasis on developing new approaches and applying additional databases in more local-oriented forecasting models that deviate from national designs. In addition, these sub-national dynamics are requiring pharma companies to develop and estimate econometrically more locally-oriented sales and marketing promotion-response models that account for these regional-based economic effects. This means the continued severity, future uncertainty, and sub-national variation in economic conditions will have impacts on the consumer that require different models from those applied in traditional pharmaceutical commercial analytics.

Therefore, in summary, the following is a non-exhaustive list of key issues currently facing pharma companies where the development of economic dynamics and the application of economic analysis will be critical to address each set of problems.

- The COVID-19 induced recession and the highest unemployment rates since the Great Depression have created significant market access (loss of health insurance) and affordability effects impacting drug utilization and potentially patient health outcomes. Economic analysis is needed to understand how this event will produce both short-term and long-term effects, as was needed with the Great Recession event of 2007-2009.

- COVID-19 has accelerated forces already at work in motivating companies to change their commercial model design. These changes are especially being driven by pandemic-induced dramatic reductions in direct sales rep-HCP engagements, the movement to digital interactions, and a significant increase in the use of telehealth by HCPs in serving patients, to name just a few trend shifts. These shifts and others will continue for the long-term, well beyond the time if/when society finds a vaccine and/or effective treatments. These trend shifts will fundamentally alter traditional pharma commercial processes and analytics, such as promotion-response modeling, marketing-mix, forecasting/prediction/scenario planning, sales force optimization and sales operations, marketing strategy and operations, payer strategy and operations, pricing analytics, launch planning, patient-level analytics, etc. Economic analysis is needed to understand these effects and how best companies should position their resources.

- Generics and biosimilars now comprise at least 90% of all dispensed prescriptions. This places greater pressure on drug company R&D to generate new novel therapies for increasingly more challenging diseases. Growth will not only come from internal R&D pipelines but also will require mergers and acquisitions to generate necessary economies of scope and scale to improve productivity. An economic analysis will be needed to understand the best opportunities for companies to achieve R&D success. Further, economic analysis is needed to demonstrate value/outcomes-based metrics of new patented medicines to counter the lower cost and value of older drug technology represented by generics and biosimilars.

- The high cost of prescription drugs is a major public policy and political issue. The industry risks the direct involvement of the federal government in negotiating drug prices, an expansion of price controls as imposed in Medicare Part B, and other threats to weakening intellectual property. Further, threats from onerous pricing policy proposals in Congress and by the President require economic analysis on their potential business impacts. The Trump administration recently announced via four executive orders the ability to control directly prices, a precursor, or more damaging policies to come if the Democrats gain control of the White House and both houses of Congress.

- There has been an ongoing shift in society wanting to see the socialization in the delivery and reimbursement of healthcare. This means pharma companies having to measure value in the context of improving patient health outcomes and lowering treatment costs. But also, companies need to demonstrate empirically how investments in developing and rewarding the diffusion of new drugs generate societal value relative to other public resource uses. Economic analysis is best positioned on how to make these value comparisons, and what trade-offs occur for society when public policies affect the development and diffusion of new medicines.

- The pharma industry has seen an explosion of new datasets as the healthcare ecosystem expands and becomes more complex. Pharma companies now have access to patient claims data, electronic health records, newer digital channels, mobility data, and the inclusion of economic metrics as recessionary effects need to be evaluated. All of these data elements are in addition to metrics that capture traditional pharma commercial sales, marketing, and payer trends. Economic models are best used to determine the value of these new datasets and their effects on strategic and tactical decision-making when changes occur.

- The increasing complexity of the pharma ecosystem requires the use of tested model designs and the application of advanced empirical methods to discern between mere correlation versus real causation of relationships. Traditional training in PhD economics is ideal in developing and testing such models for practical business decision-making.

How Axtria Can Help Clients with Applying Economic Analysis to Key Pharma Business Issues

Tech companies have already realized the benefits the applications of advanced economic analysis can play in addressing commercial problems in their industry. Amazon has hired more than 150 PhD economists, with Google, Facebook, and Microsoft also engaged in aggressively hiring [5]. Authors of a 2019 Harvard Business Review article noted five questions economists can help tech companies answer, which very much mirror questions facing pharma companies [5].

Axtria’s think tanks in Decision Science, Commercial Excellence, and Business Information Management have developed innovative solutions and useful insights to help pharma clients with the preceding key business issues involving economic dynamics. Axtria also has trained advanced-degree economists with pharma industry experience to assist clients in finding actionable solutions from adapted commercial analytics incorporating these important economic dynamics.

Furthermore, the existence of the COVID-19 pandemic has accelerated existing forces and economic dynamics that were already in place, causing changes in pharma commercial models and analytics. Genentech, for example, publicized in July 2020 a new customer engagement model, with its purpose and means of execution expressed in the following quoted paragraph [6]:

We are transitioning from a traditional pharma organizational and territory model to one focused around local health care ecosystems with new specialty roles. For example, each ecosystem is led by both a commercial and a medical executive director, both of whom have deep local health system knowledge and expertise. The new model aims to help health care systems improve patient experience and outcomes, support population health, and reduce costs through streamlined touchpoints and local expertise that better align with the way care is delivered in communities across the United States today.

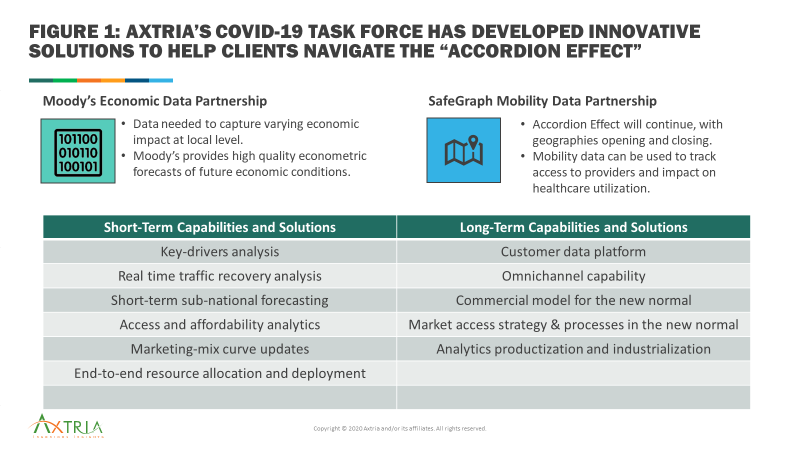

Axtria has leveraged its expertise to assist clients in navigating through COVID-19 induced business challenges. For example, Axtria’s COVID-19 Task Force has developed innovative solutions to help clients navigate the “accordion effect” [3], as illustrated below in Figure 1.

Source: Axtria Inc.

![]() Learn More - How Will The Accordion Effect Impact Your Brand Performance In Q4-2020 And Q1-2021?

Learn More - How Will The Accordion Effect Impact Your Brand Performance In Q4-2020 And Q1-2021?

If you are interested in how economic dynamics are affecting the development and application of commercial analytics, please contact us (directly below). Axtria would be delighted to help and ensure that your commercial analytics team is prepared for the challenges brought about by changing economic dynamics, while allowing us to ensure that potentially life-saving medications continue to get to the appropriate patients.

Given the dynamic nature of this pandemic, please read articles on the Axtria Research Hub and Axtria Blogs for updates.

References

- Torry H. U.S. economy see record downturn. The Wall Street Journal 2020; 31 July: A1, A4.

- Morath E. Jobless claims are lowest since March. The Wall Street Journal 2020; 7 August: A2.

- Naphade K. How will the accordion effect impact your brand performance in Q4-2020 and Q1-2021. Axtria Blogs, published online 1 July 2020, available at https://insights.axtria.com/blog/how-will-the-accordion-effect-impact-your-brand-performance-in-q4-2020-and-q1-2021.

- Chressanthis G. COVID-19 recession effects on pharmaceutical related patient health outcomes. Axtria Research Hub, published online June 2020, available at https://insights.axtria.com/white-papers/covid-19-recession-effects-on-pharmaceutical-related-patient-health-outcomes.

- Athey S and Luca M. Why tech companies hire so many economists. Harvard Business Review, published online 12 February 2019, available at https://hbr.org/2019/02/why-tech-companies-hire-so-many-economists.

- Oaks N and Freedman J. Pioneering a new customer engagement model during COVID-19. Genentech, published online 17 July 2020, available at https://www.gene.com/stories/pioneering-a-new-customer-engagement-model-during-covid-19.

Before joining Axtria, Kedar was a Principal with marketRx, and prior to that an analytics consultant with Bell Labs, Lucent Technologies.