Continuing our blog series examining a ‘year in the life’ of Sales Strategy and Operations. This time of the year (late spring, early summer) marks the classic sales force sizing season. Why now? Many executives engage in the strategic planning and/or anticipate next year’s budgeting process, which is why this is a perfect time to take a fresh look at the overall sales force investment.

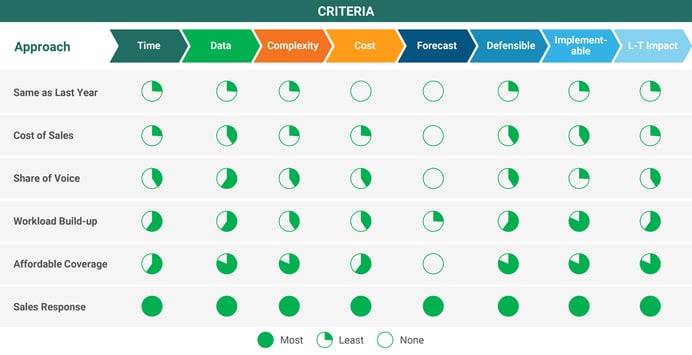

In Part 1 of this blog (Sales Force Size - Classic Approaches), we discussed the six classic sales force sizing methodologies. In this part, we will further explore which approach to use in a given situation.

When considering which approach to use, there are several business, data, financial, and decision-making trade-offs to consider. For example, if you need insights on sales force size by next week, that will certainly limit your options. However, if you have a CXO who demands (and appreciates) an ROI and sales forecast (e.g., 50 more sales people will generate $x next year and $y the year after), you will want to consider sales response modeling.

Based on our 25 years in the trenches, we frequently navigate the following considerations:

- Time: How long does it take to conduct the analysis?

- Data: Are the underlying data readily available? Are the inputs / assumptions easy to get?

- Complexity: How difficult is the ‘math’?

- Defensible: Can the approach pass muster with a CFO / CEO?

- Forecast: Does it generate estimates of sales and profits?

- Implementable: Can outputs be used to deploy, align, guide, and incent the sales force?

- Cost: How costly is the approach?

- Long term impact: Does the organization learn / get better?

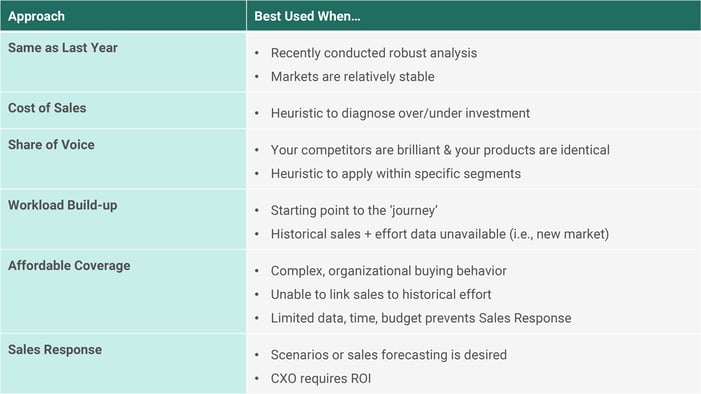

The table below summarizes when to use a particular approach.

At Axtria, we are big fans of ‘and’, rather than stressing over whether to do approach ’A or B’, we consider using several methods in parallel or in sequence.

If you need a quick diagnostic on your sales force size, perhaps start with your sales force size over the past three to five years, compare the financial trend (has sales investment kept pace with revenue growth?), and look at key competitors to check your share of voice.

Learn More - "The Evolution of Pharma Field Force Deployment and Targeting"

At Axtria, we are also big fans of ’crawl-walk-run’. Frequently, we work with clients to embark on a journey of increasing sophistication and value. For example, Workload Build-up is a great starting point. The approach requires clearly identifying and quantifying customer segments, delineating the sales roles, and specifying the work that must be done to sell / service each segment. Not bad for a first turn of the crank. As you complete this exercise, you can put in place the foundation and processes to become more advanced (e.g., better sales activity tracking, test/control experiments to measure sales impact, etc.).

The next step could be to apply Affordable Coverage type-economics, such as developing assumptions around ’sales due to effort’ and ’carryover’, as well as better understanding costs by segment. As your processes, data, analytics, and executive appetite for analysis improve, you can commence more sophisticated sales response modeling. Once you’ve conquered sales response modeling, consider overall marketing mix analysis whereby your sales force investment is considered in the context of all your marketing related spending (online, offline).

Read More: “Is Channel ROI Dead?”

What additional sales force size approaches have you used? What considerations and trade-offs have guided your decisions?

Are you wondering whether your sales force size is appropriate? Has your product portfolio or market landscape changed significantly? Please contact us here to compare notes, we’d love to learn more about your business.

Learn more about Axtria's Sales Force Size & Structure capabilities.