-

Products

-

Product Portfolio

-

Accelerate actionable business insights from trusted and secure data

-

Enterprise-grade insights for emerging pharma

-

Agentic AI Life Sciences platform with 30+ agents for deployment and experimentation

-

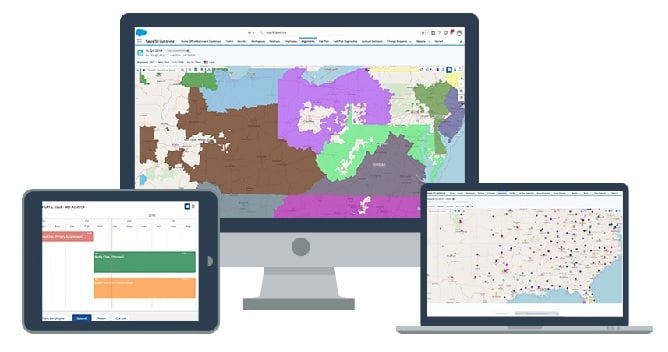

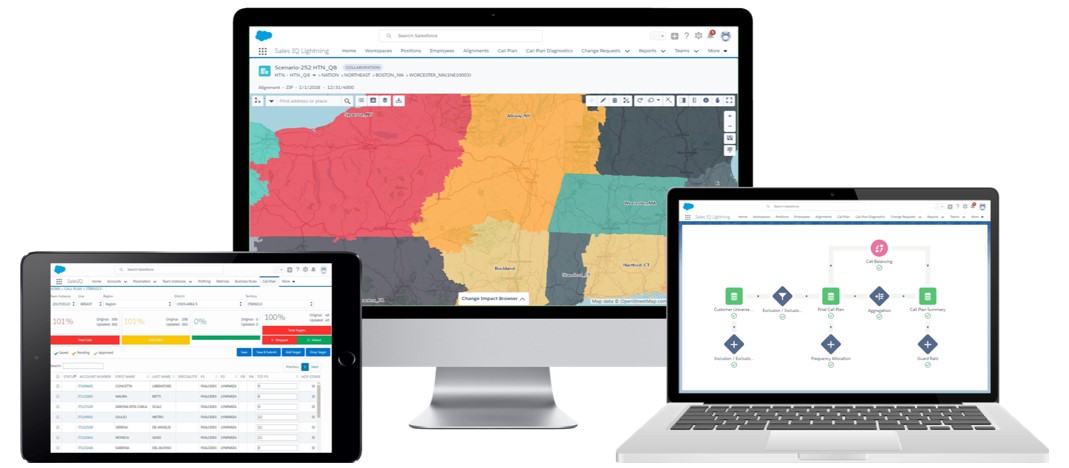

Optimize sales team customer engagement and drive higher commercial success

-

Leverage next best action (NBA) driven omnichannel customer engagement

-

Democratize marketing analytics to achieve strategic performance

-

-

Product Release Notes

Latest Product Release Notes

-

Product Portfolio

-

Solutions

-

Industries

-

Industries

Software that delivers life sciences data to insights to planning to operations.

Learn More

-

-

Insights

-

Ignite Webinar Series

-

Research Hub

Latest Insights

-

Industry Primers

Latest Insights

Industry Primer

Optimizing Sales Excellence: A Comprehensive Guide to Sales Performance Management

Learn More

Learn More

-

Blogs & Infographics

Latest Insights

Blog

NexGen Commercial Intelligence: How Generative and Agentic AI are powering Field Force...

Learn More

Learn More

Blog

Cell & Gene Therapies for Rare Diseases: Unlocking New Possibilities with Real-World Data

Learn More

Learn More

-

Customer Success Stories

Latest Insights

Case Study

Building a Scalable Data Governance Foundation: The Modernization Journey of a Global...

Learn More

Learn More

Case Study

Transforming Women's Health: Delivering High Accuracy with AI/ML-Driven Forecasting for...

Learn More

Learn More

-

Podcasts & Videos

Latest Insights

-

Fact Sheets, Data Sheets & Guides

Latest Insights

Fact Sheet

Axtria DataMAx™ - Accelerate actionable business insights from trusted and secure data

Download Fact Sheet

Download Fact Sheet

-

Media Wall

Latest Insights

Media Wall

Axtria Ignite 2025: Madhavi Ramakrishna on leadership, culture, and AI transformation |...

Learn More

Learn More

Media Wall

What Does It Take to Scale AI for Impact Beyond Proofs of Concept : Panel Discussion With...

Learn More

Learn More

Media Wall

What It Really Takes to Move AI Beyond the Pilot Phase: Insights from MachineCon NY

Learn More

Learn More

-

Newsletter

THE AXTRIA COLLECTIVE

Get the latest topics, trends, and high-value insights with thought-provoking content from the ever-changing landscape of the life sciences industry.

March 2025

NexGen commercial intelligence, case study on transforming territory alignment, and more

View Newsletter

View Newsletter

-

Ignite Webinar Series

-

About

-

Our Story

Passionate people transforming patient lives

-

Business Sustainability

Making a positive impact on the environment

-

Culture

We are Individually diverse & collectively inclusive

-

Partnerships & Alliances

Delivering value through an ecosystem of partners

-

Careers

Connect with us – We’re ready to talk opportunities

-

Newsroom

Latest announcement and media coverage

-

Contact Us

Axtria Inc. 300

Connell Drive, 5th & 6th Floor,

Berkeley Heights, NJ 07922

United States+1-877-929-8742

connect@axtria.com

-

Our Story

Contact Us

Axtria Inc. 300

Connell Drive, 5th & 6th Floor,

Berkeley Heights, NJ 07922

United States

+1-877-929-8742

connect@axtria.com

Copyright © 2025 Axtria. All Rights Reserved.

Axtria Cookie Policy & Privacy Statement.